Decoding SaaS Pricing Lingo: 35 Terms Every SaaS Founder Should Know

Unlock the jargon of SaaS pricing: a glossary for Founders and SaaS specialists to simplify complex concepts and drive smarter decisions

Dec 10, 2024

Pricing and billing in SaaS often involve technical terms that evolve rapidly. As a busy founder focused on growing your business, keeping up with these terms may not be a priority.

If that sounds like you, or if you're simply curious about pricing and billing concepts, here are 35 essential technical terms commonly used in SaaS pricing and billing. Each term includes a clear definition and an example to illustrate its use.

Billing basics

Billing vs Invoicing

Definition:

Invoicing is the process of creating an invoice, a document that outlines the payment details, including the total amount, taxes, and company identifiers. Invoicing is a subset of billing, as billing encompasses broader aspects such as the management of subscription plans, associated features, pricing, and the generation of invoices. While invoicing focuses on payment documentation, billing involves the entire workflow around charging customers.

Example:

Chargebee is a comprehensive billing software that helps SaaS businesses define and manage subscription plans, integrate them with their products, and handle payments. Chargebee is capable of handling the majority of SaaS pricing models making it a reference in the billing software ecosystem.

Chargebee's billing software is among the most renowned names in billing software.

Billing Infrastructure

Definition:

Billing infrastructure is the technical foundation that manages billing logic and integrates it with a SaaS product. This infrastructure can be developed in-house, outsourced to specialized billing software, or built using a combination of third-party tools and custom middleware. It manages essential functions like pricing rules, subscription handling, and invoicing while ensuring scalability and reliability.

Example:

Companies using a usage-based pricing model often rely on dedicated billing platforms like Lago, which are designed to handle complex billing requirements. Alternatively, some businesses use Stripe Billing and add custom code to overcome its limitations for usage-based models, creating a tailored billing infrastructure.

Stripe billing is the billing software available on top of its Payment service provider product

Billing Period

Definition:

The billing period refers to the duration during which a subscription plan is valid. At the end of this period, most SaaS businesses apply automatic renewals unless the customer cancels. Billing periods are typically monthly, quarterly, or yearly, allowing flexibility for different customer preferences.

Example:

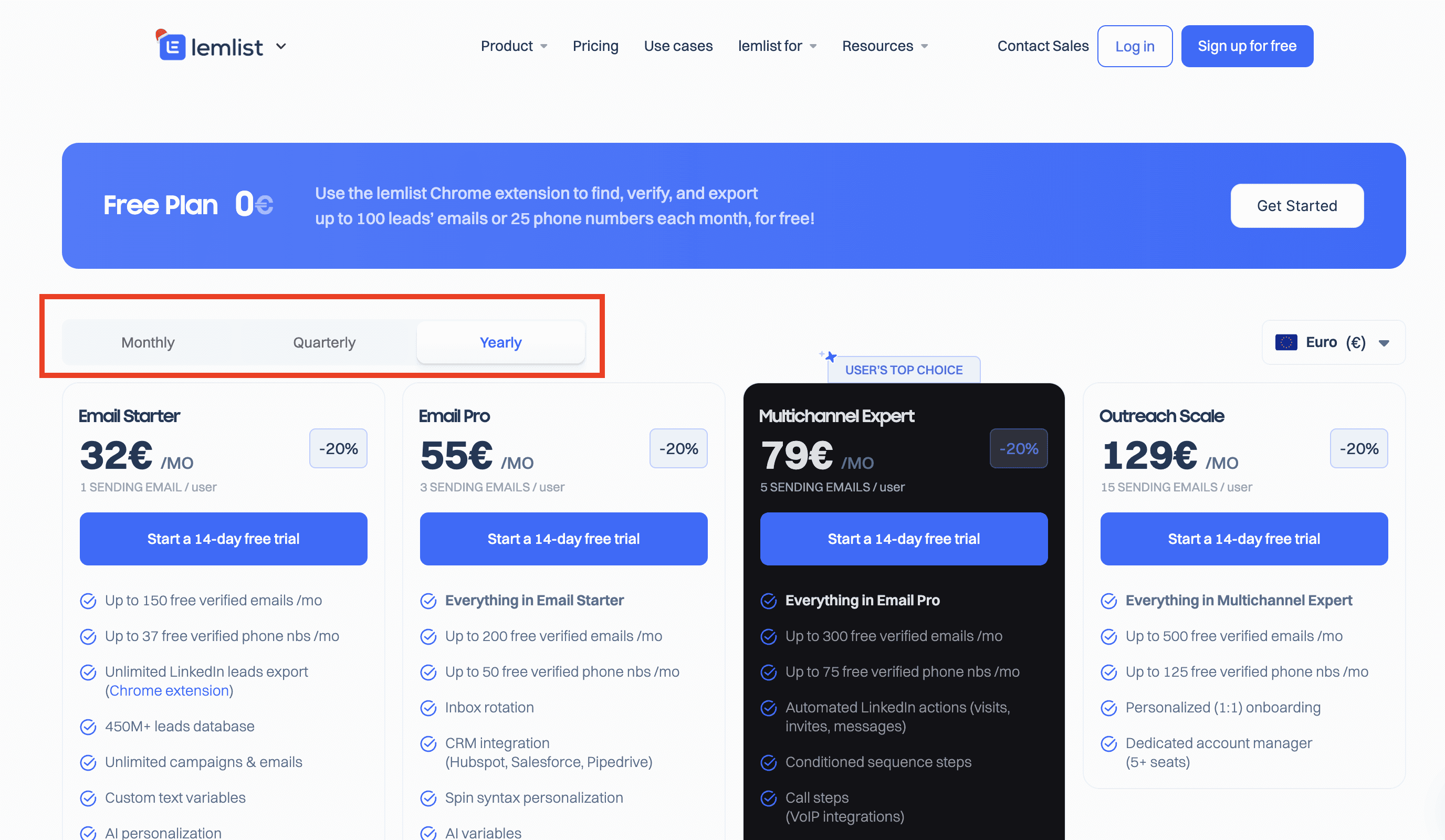

Lemlist offers three billing periods: monthly, quarterly, and yearly. Customers who commit to longer periods, such as yearly billing, often receive discounted rates compared to monthly payments, encouraging long-term subscriptions.

Lemlist’s pricing page

Payment Service Provider

Definition:

A payment service provider (PSP) is a tool embedded into a website or application to process customer payments. PSPs handle transaction security, compliance, and technical integration, making them essential for businesses that prefer not to build payment systems in-house.

Example:

Popular PSPs include Stripe, which supports credit card payments; LemonSqueezy, designed for SaaS businesses; and GoCardless, which focuses on direct debit and wire transfers. These tools streamline the payment process for both businesses and customers.

Lemonsqueezy is a Stripe competitor that just got acquired by Stripe

Quote-to-Cash (QTC)

Definition:

Quote-to-Cash (QTC) refers to the complete process from generating a customer quote to collecting payment. It includes stages like quote creation, contract negotiation, order management, billing, and payment collection. The goal of QTC is to streamline these interconnected processes to improve operational efficiency, accuracy, and customer experience.

Example:

Revenue operations teams often enhance QTC workflows by integrating tools like Salesforce or HubSpot CRM with billing software like Chargebee or Stripe. For instance, automation between Salesforce CPQ and Salesforce Billing ensures seamless transitions from quote generation to invoice creation, reducing errors and delays.

Configure-Price-Quote (CPQ)

Definition:

Configure-Price-Quote (CPQ) software helps businesses generate tailored quotes for customers by automating pricing and configuration processes. It simplifies complex pricing models and ensures consistency by integrating with CRM systems, allowing sales teams to offer precise quotes quickly.

Example:

Salesforce CPQ is a widely used tool that allows sales teams to create custom quotes for clients with unique pricing requirements. After a quote is finalized, Salesforce Billing ensures invoices are generated and tracked, maintaining a smooth workflow from sales to finance.

Salesforce CPQ enables sales people to generate custom quotes directly from Salesforce

Hybrid Pricing Plans

Definition:

Hybrid pricing plans combine multiple pricing models—such as feature-based, usage-based, or tiered pricing—into a single plan. These plans cater to a wide range of customer needs by blending the flexibility of different pricing strategies.

Example:

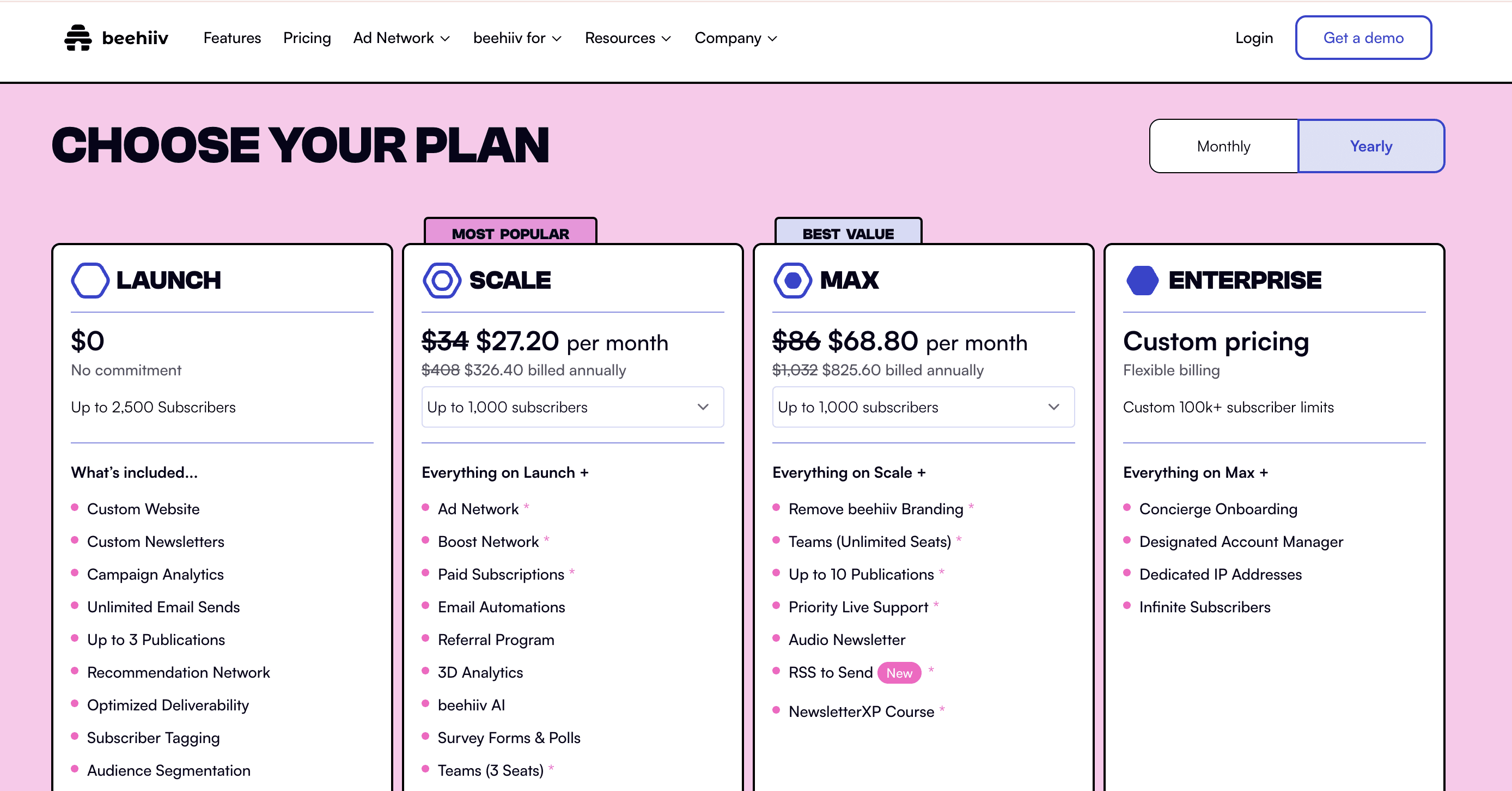

Beehiiv employs a hybrid pricing model. Each plan limits the number of subscribers and features available, combining tiered and feature-based pricing. This approach provides flexibility for growing businesses while encouraging upgrades as subscriber counts increase.

Beehiv’s pricing page

SKUs

Definition:

In SaaS, a Stock Keeping Unit (SKU) represents a unique combination of pricing, features, and entitlements within a plan. SKUs are similar to tiers or plans and can also include add-ons. Each SKU determines what a customer can access based on their subscription.

Example:

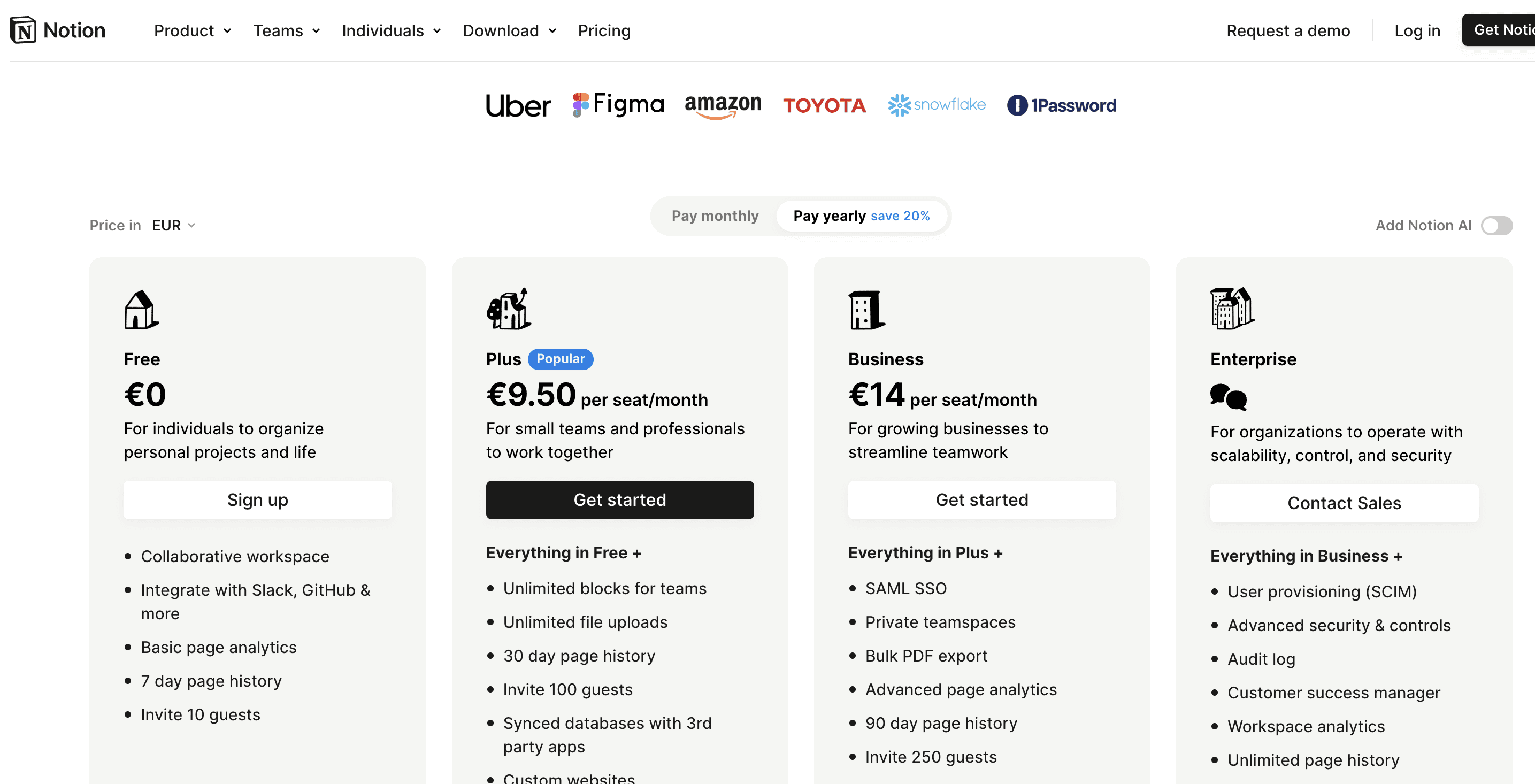

Notion offers four SKUs: three tiers (Plus, Business, and Enterprise) and an add-on (Notion AI). These options allow customers to choose plans based on their needs while adding features like AI tools for enhanced functionality.

Notion’s pricing page

Add-ons

Definition:

Add-ons are additional features or services sold separately from subscription tiers. They are typically optional and allow customers to customize their plans. Add-ons often include advanced functionalities that complement core features.

Example:

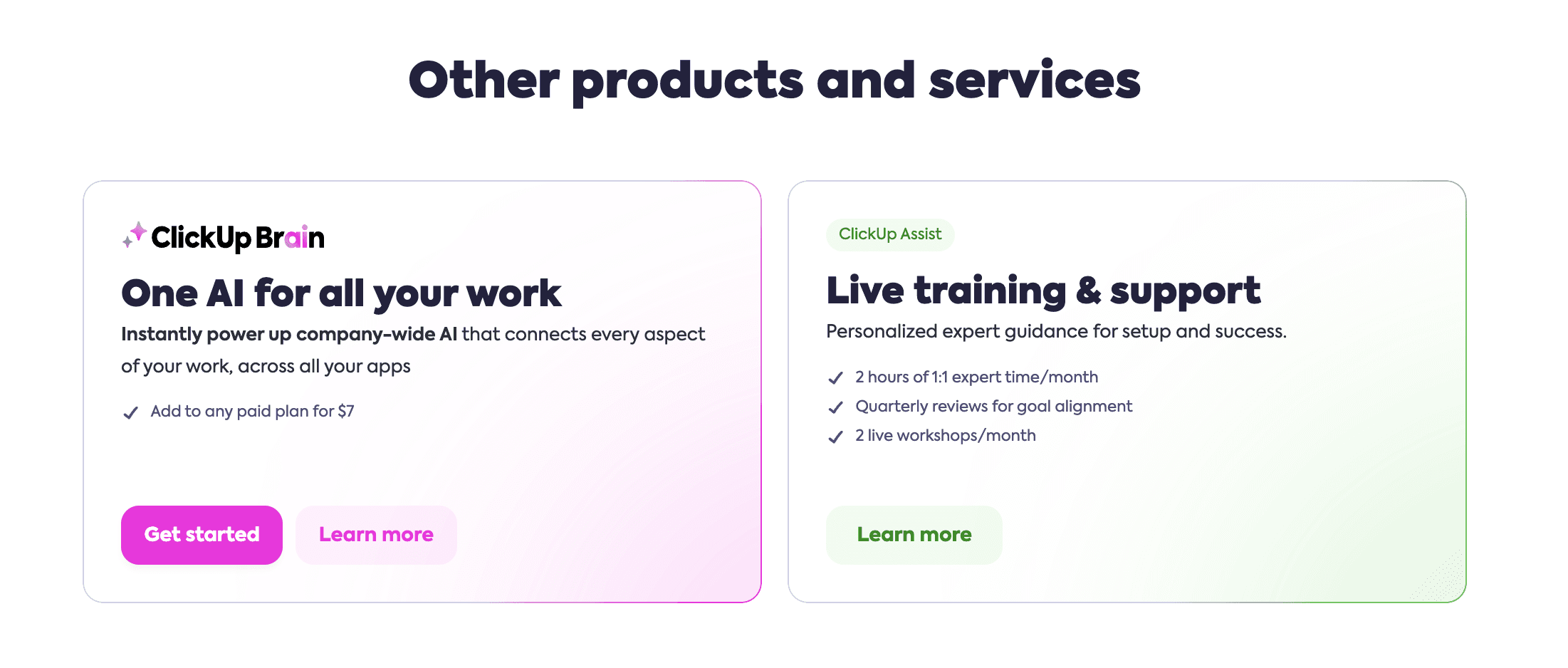

ClickUp monetizes its AI features through an add-on called "ClickUp Brain." This allows users to leverage AI tools regardless of their chosen subscription tier, offering value without requiring a plan upgrade.

Clickup’s AI add-on

Billing processes and strategy

Dunning / Recovery Process

Definition:

The dunning process encompasses all mechanisms employed to recover failed payments in SaaS businesses. This includes flagging customers at risk of payment failure, automating email reminders, and offering convenient methods for updating payment information. Effective dunning processes aim to minimize revenue loss and maintain customer retention by addressing payment issues proactively.

Example:

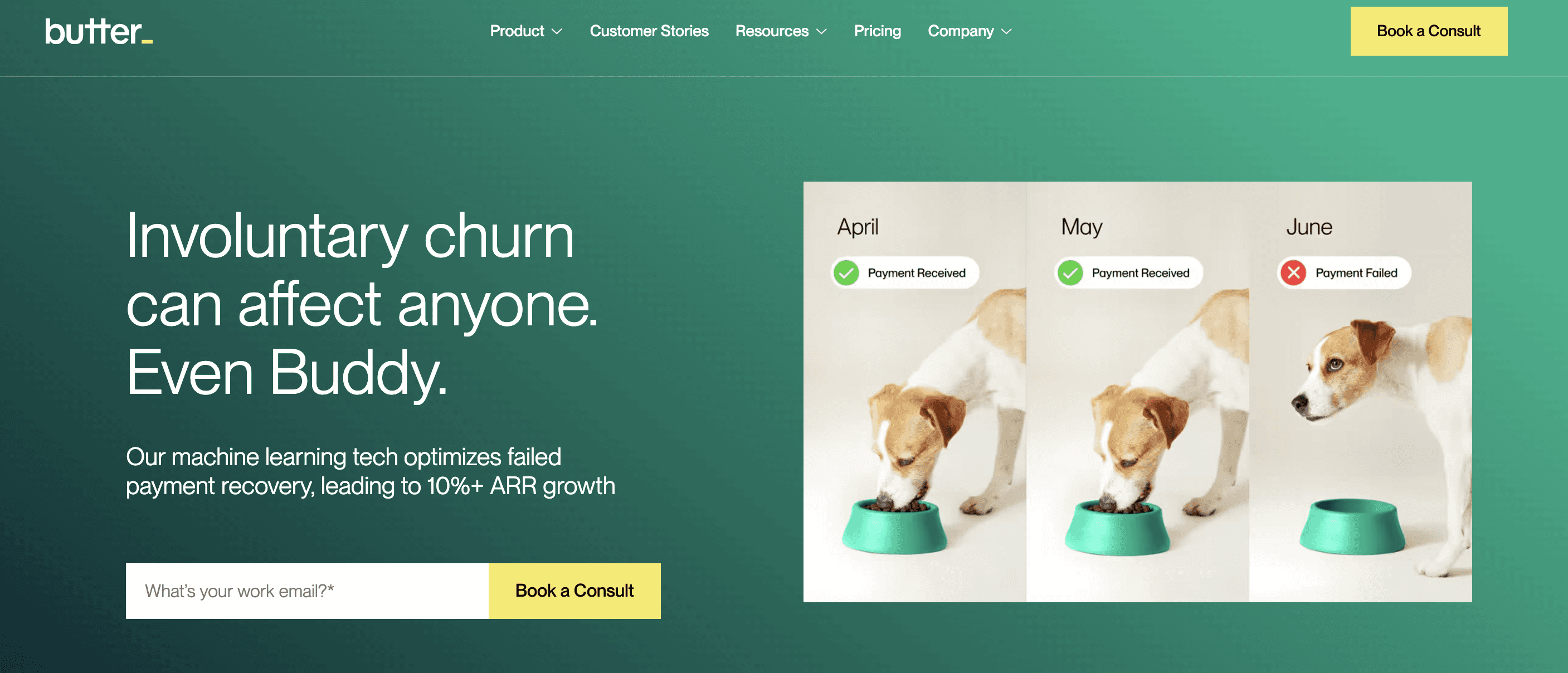

A product like Butter Payments specializes in automating dunning processes. They integrate seamlessly with billing software, streamlining recovery efforts by sending automated reminders, retrying failed transactions, and optimizing payment recovery rates. These tools significantly reduce the number of outstanding payments for SaaS businesses.

Butter payment enables to set-up workflow to recover payments

Grace Period

Definition:

A grace period refers to the extra time provided to customers after a missed payment deadline before access to the product or service is suspended. This period allows customers to resolve billing issues without losing service access, ensuring a better customer experience and increasing the likelihood of payment recovery.

Example:

Spotify offers a grace period for its premium subscriptions. If a payment fails, users are given a limited number of days to update their payment information before their account is downgraded to the free plan. This approach helps maintain user satisfaction while encouraging timely payment resolution.

Credit Note Issuance

Definition:

Credit note issuance is the process of creating a formal document to adjust previous invoices. It is typically used to issue refunds, account for discounts, or correct billing errors. Credit notes serve as official records of adjustments and help maintain transparency in financial transactions.

Example:

Chargebee simplifies credit note issuance by linking them to specific invoices. For instance, if a customer cancels an annual subscription after six months, Stripe can automatically generate a credit note for the unused portion, streamlining the refund process and ensuring accurate accounting.

Grandfathering

Definition:

Grandfathering is the practice of allowing existing customers to continue using an older pricing structure while new customers are subject to updated pricing. This strategy helps maintain loyalty among existing customers while transitioning new ones to the revised pricing.

Example:

Companies like Livestorm and Senja have implemented grandfathering strategies during pricing changes. For a detailed example of how they managed this transition, see this article on grandfathering strategies.

Differential Pricing

Definition:

Differential pricing is a strategy where businesses charge different prices for the same product or service based on factors such as customer segment, geographic location, or usage. The objective is to maximize revenue and cater to a diverse customer base.

Example:

Slack employs differential pricing by offering discounted rates to nonprofits and educational institutions. Standard business users pay the full price, while these specialized segments benefit from reduced rates, enabling Slack to appeal to a broader range of customers.

Professional Services

Definition:

Professional services refer to one-time, paid services offered by SaaS companies to support customers, typically enterprise clients, with the implementation or customization of their software. These services are distinct from recurring subscription revenues and are excluded from Annual Recurring Revenue (ARR) calculations.

Example:

Trustpair offers professional services to help their customers implement their wire transfer fraud prevention solution. These implementation fees are charged separately from the subscription, ensuring that enterprise clients can effectively deploy the product within their organizations.

Trustpair’s home page

Pricing Grid vs. Rate Cards

Definition:

A pricing grid is a visual table comparing multiple pricing tiers, plans, and features, commonly used in SaaS to present options to customers. A rate card, in contrast, is a detailed document listing all potential charges for services, often utilized in enterprise negotiations or for billing professional services.

Example:

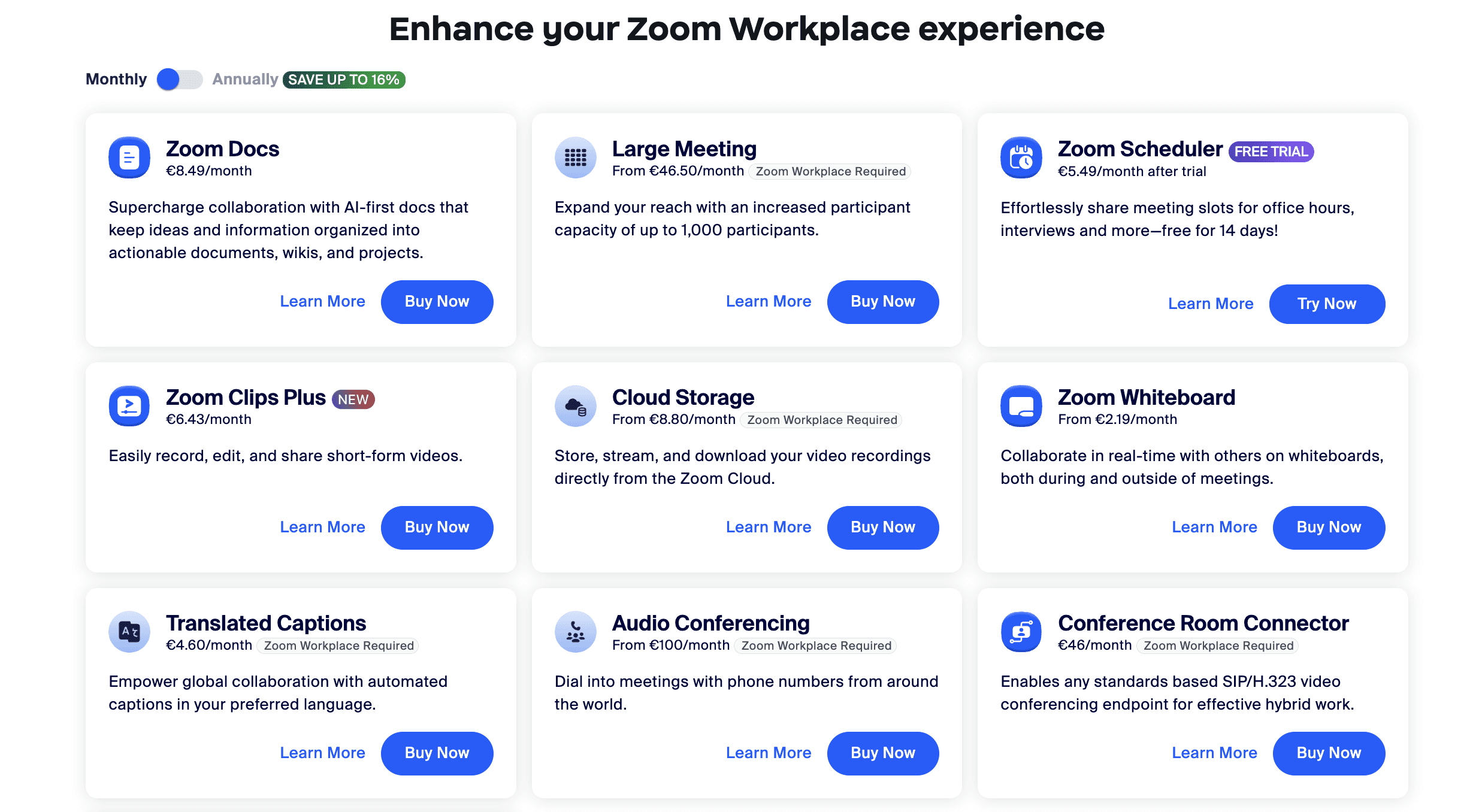

Pricing grid: Zoom showcases its plans in a grid format, allowing customers to compare Basic, Pro, Business, and Enterprise tiers based on features like meeting duration and participant capacity.`

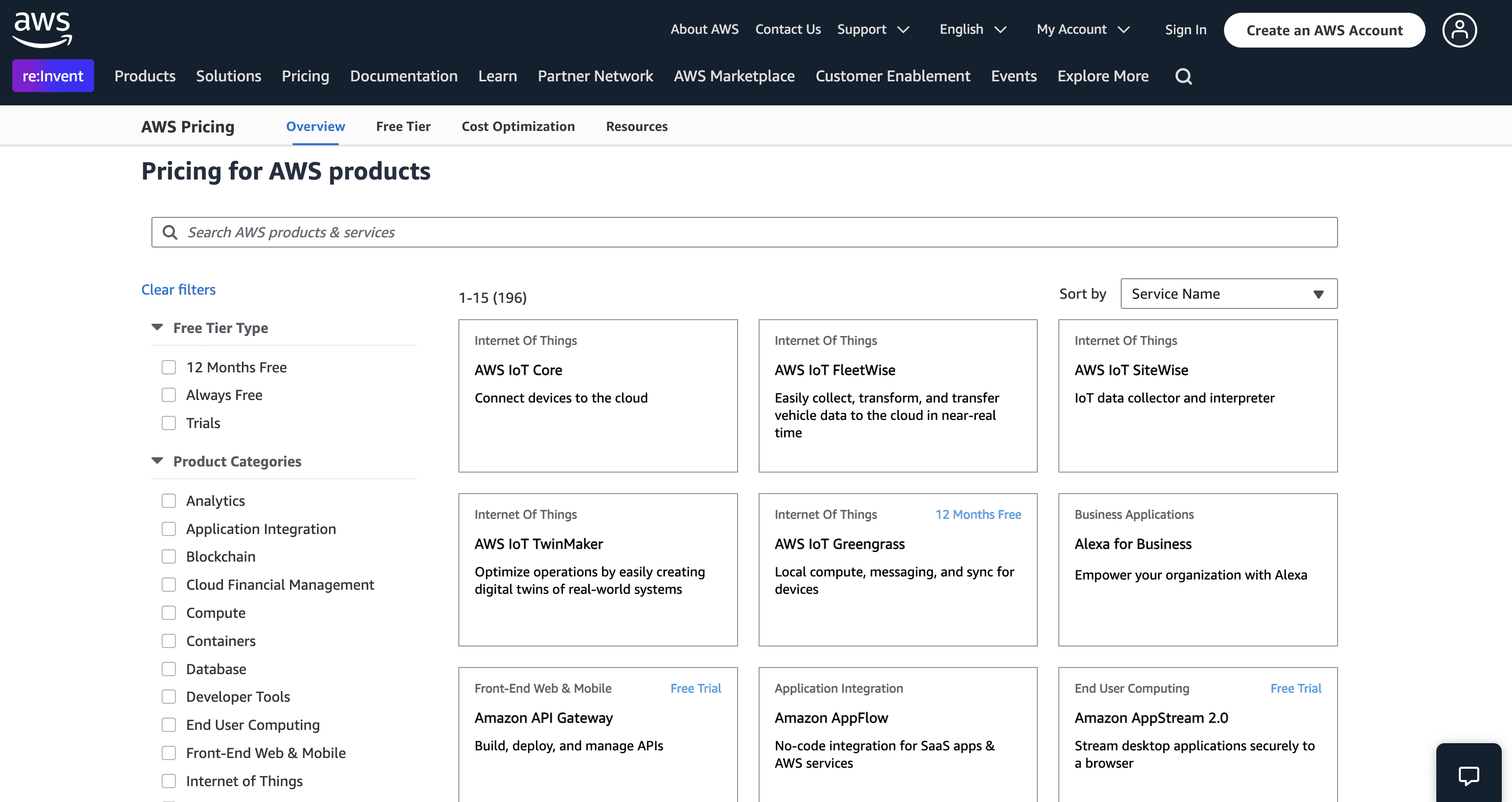

Rate card: AWS provides a detailed rate card outlining the costs of various resources, such as compute and storage, enabling enterprise customers to estimate costs based on usage.

AWS rate card

Sales-Led vs. Product-Led Growth (PLG) Plans

Definition:

Sales-led plans are custom plans created manually by sales teams after negotiating terms with customers (often called "customer provisioning"). Product-Led Growth (PLG) plans, on the other hand, are standardized plans that customers subscribe to directly online, typically after experiencing a freemium or trial version.

Example:

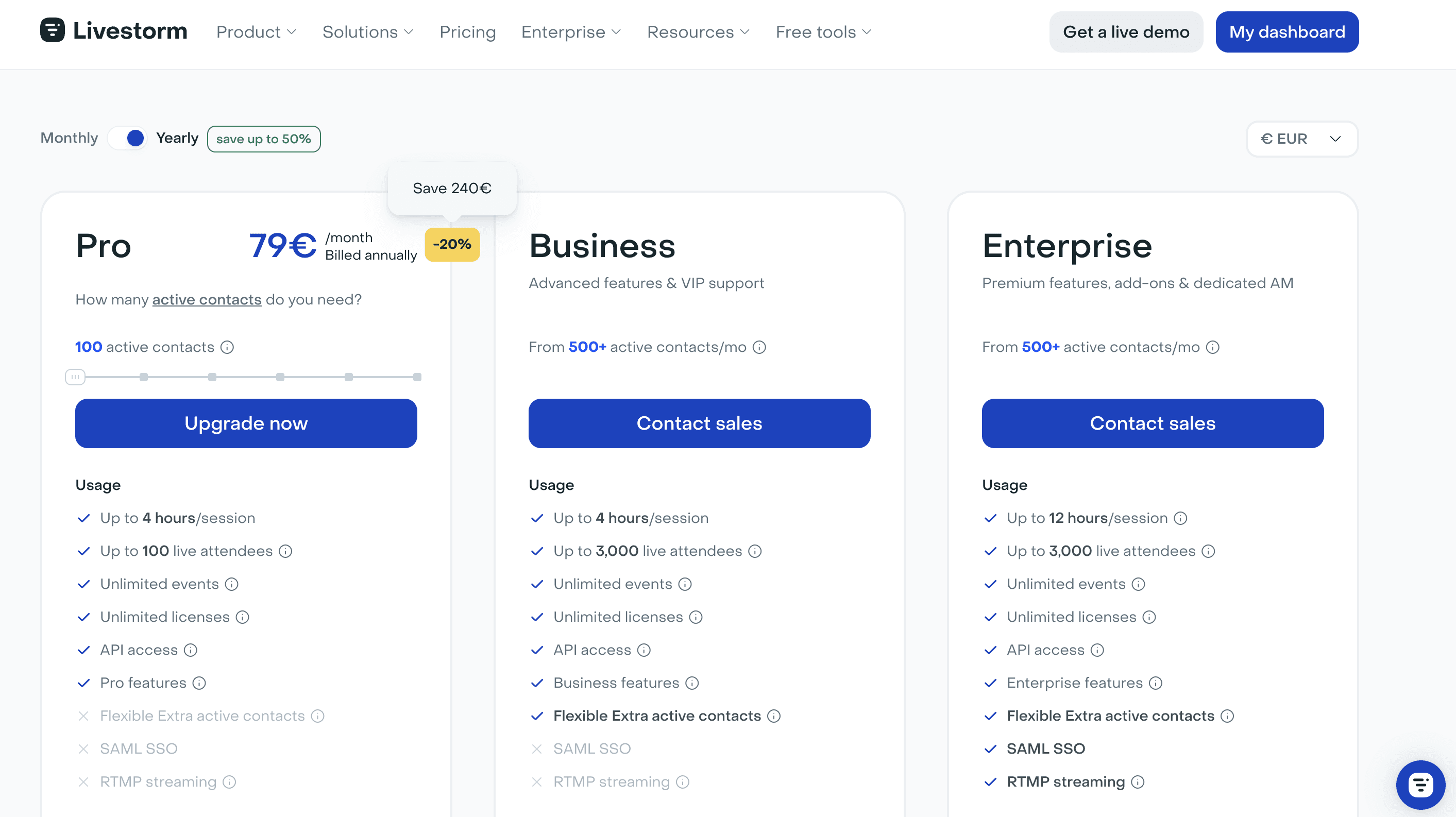

At Livestorm, enterprise plans are sales-led, with custom terms negotiated by sales representatives and manually configured (e.g., pricing, active users, and contract length). In contrast, self-serve plans allow customers to sign up for a subscription directly from the product after using the freemium version, showcasing the PLG approach.

Livestorm’s pricing page displays both Sales-Led and PLG plans

Usage-based billing

Metered Billing

Definition:

Metered billing applies to software with a usage-based pricing model, where customers are billed at the end of the billing period (e.g., monthly) after their usage or outcomes have been fully measured. This model ensures that customers only pay for what they have consumed during the billing cycle.

Example:

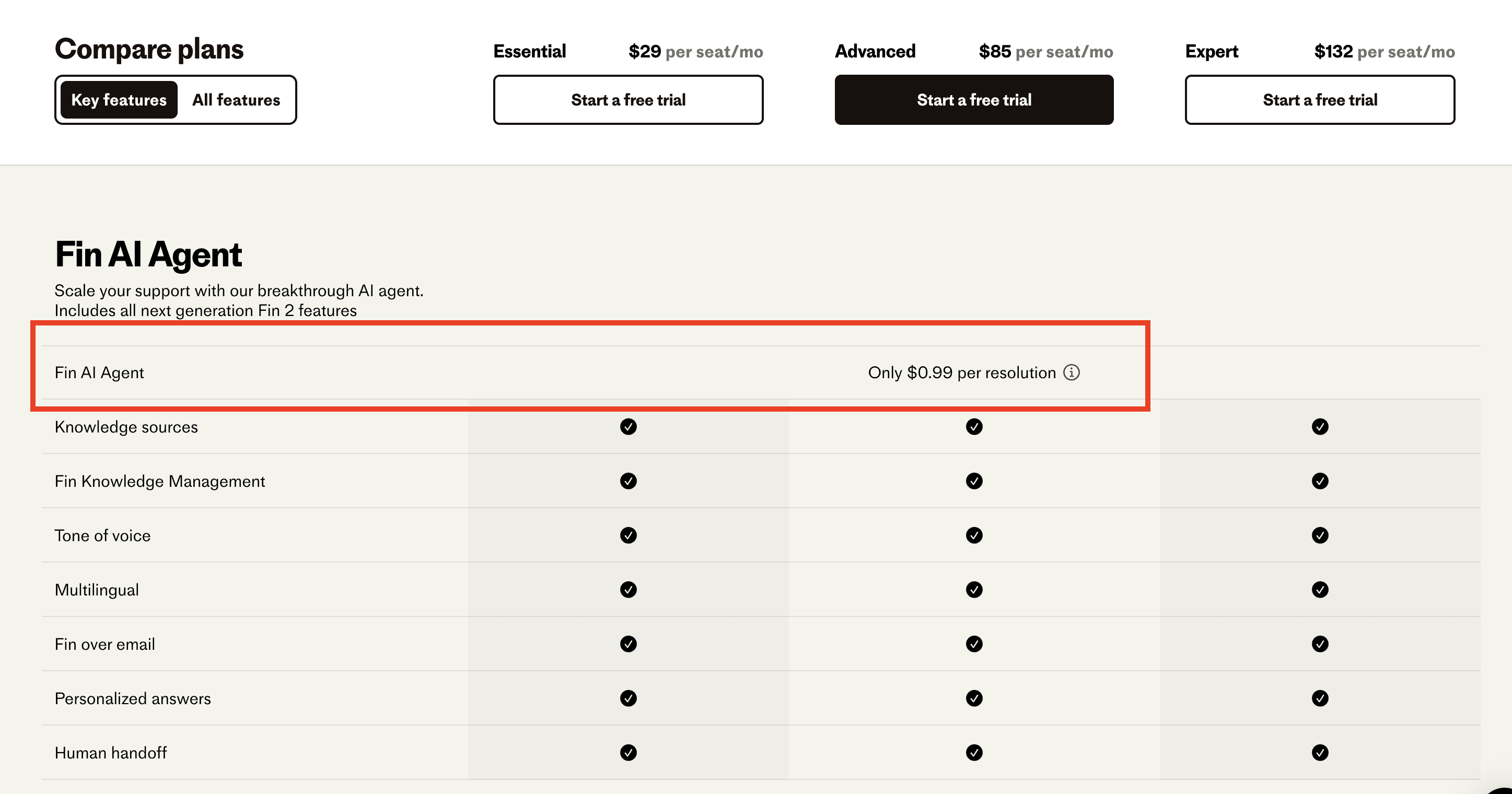

Intercom Fin AI charges customers based on the number of support tickets resolved during the month. At the end of the billing period, the total ticket count is calculated, and the corresponding amount is billed to the customer.

Intercom Fin AI’s charges at the end of the billing period based on the number of tickets resolved via this agent

Billable Metric

Definition:

A billable metric is the specific metric a billing system uses to calculate charges and generate invoices. It represents the quantified unit of usage, such as credits, API calls, or users, that directly impacts the final cost to the customer.

Example:

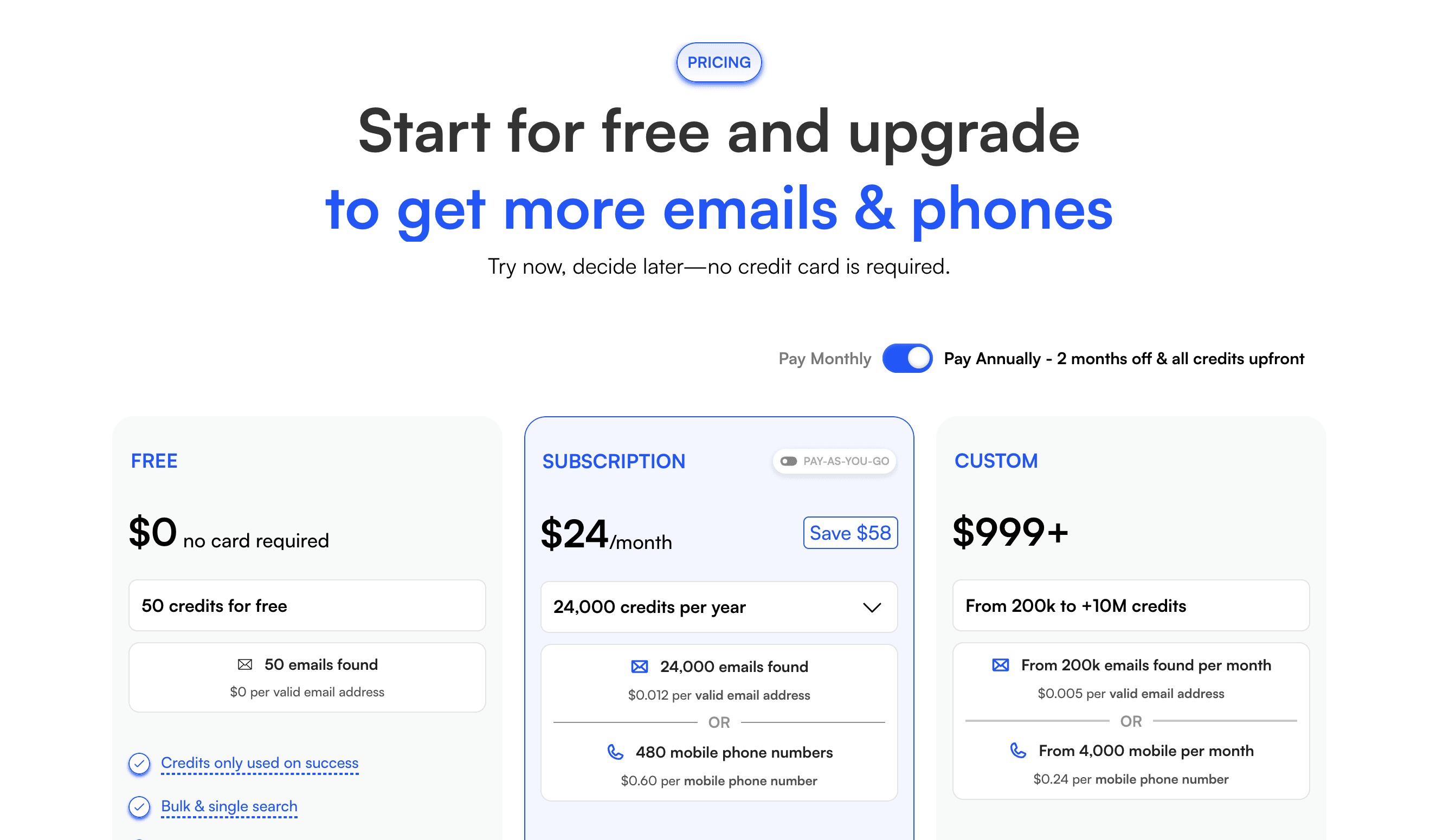

Enrow uses credits as its billable metric. For instance, one valid phone number search equates to 50 credits. While "valid phone number" is the actual usage, the invoice is based on the corresponding credit consumption, emphasizing the importance of billable metrics in pricing.

Enrow has a credit-based pricing model

Usage Metering

Definition:

Usage metering is the process of tracking and measuring customer usage of a product or feature. This data forms the basis for computing billable metrics. Usage metering can be achieved through database queries or by integrating tools like Segment, Amplitude, or Lago to log and process usage events.

Example:

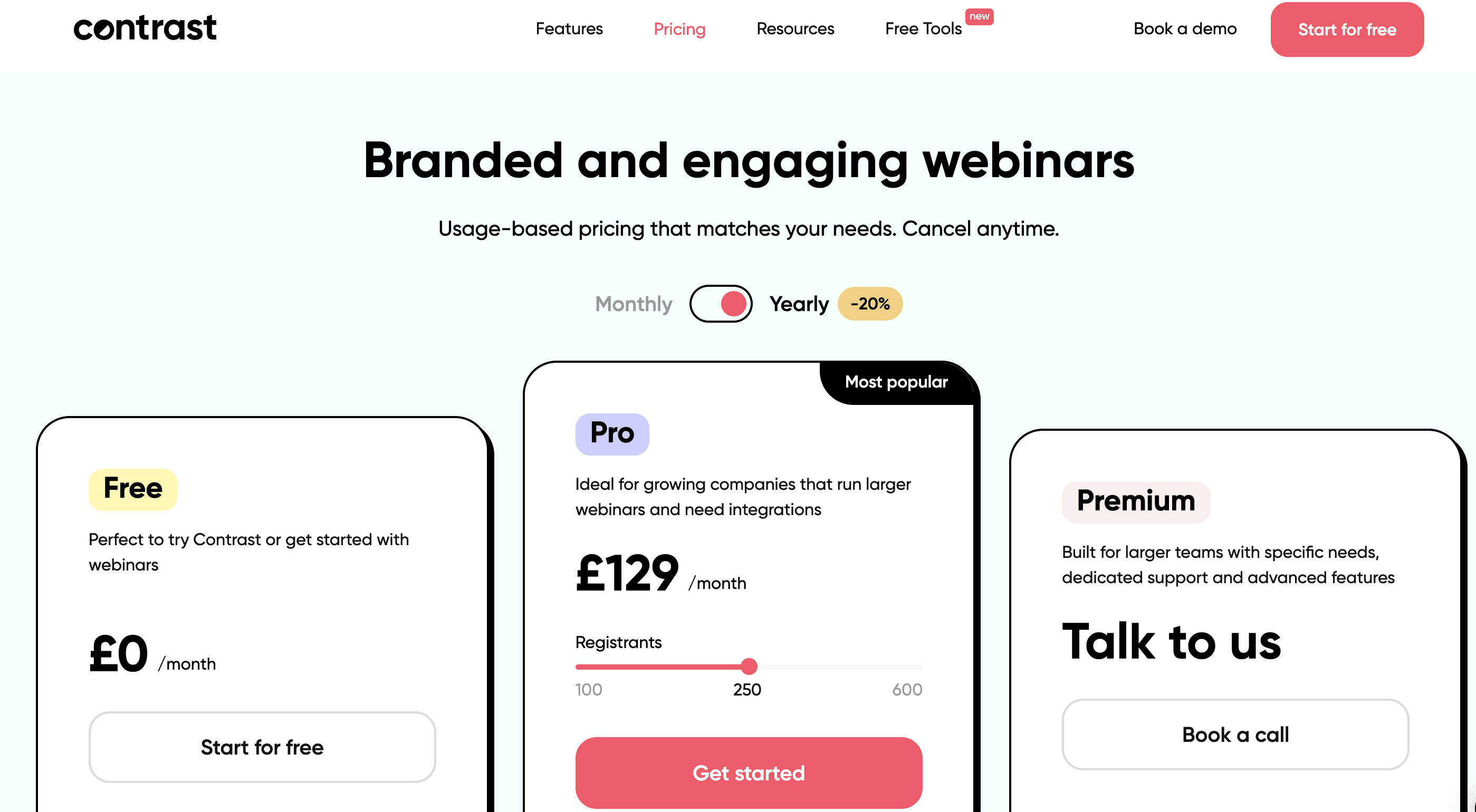

Contrast charges based on the number of unique webinar registrants per customer. Usage metering involves tracking the number of registrations logged for each webinar, which serves as the input for billing calculations.

Contrast’s pricing page

Usage Aggregation

Definition:

Usage aggregation is the process of transforming raw usage data into a billable metric. This involves applying computations such as summing usage events, counting unique occurrences, or identifying maximum or minimum values over a specified period.

Example:

Using Contrast’s pricing model: after metering the total webinar registrations per customer, usage aggregation calculates the billable metric by summing distinct registrants per customer ID for the billing period. For example, a SQL query might be:COUNT(DISTINCT registration_id) FROM registrations WHERE billing_period GROUP BY customer_id.

Progressive Billing

Definition:

Progressive billing is a method where customers are billed incrementally throughout the billing period. This approach is common in usage-based or long-term contracts and helps reduce the risk of large, unexpected charges at the end of the period, encouraging better payment compliance.

Example:

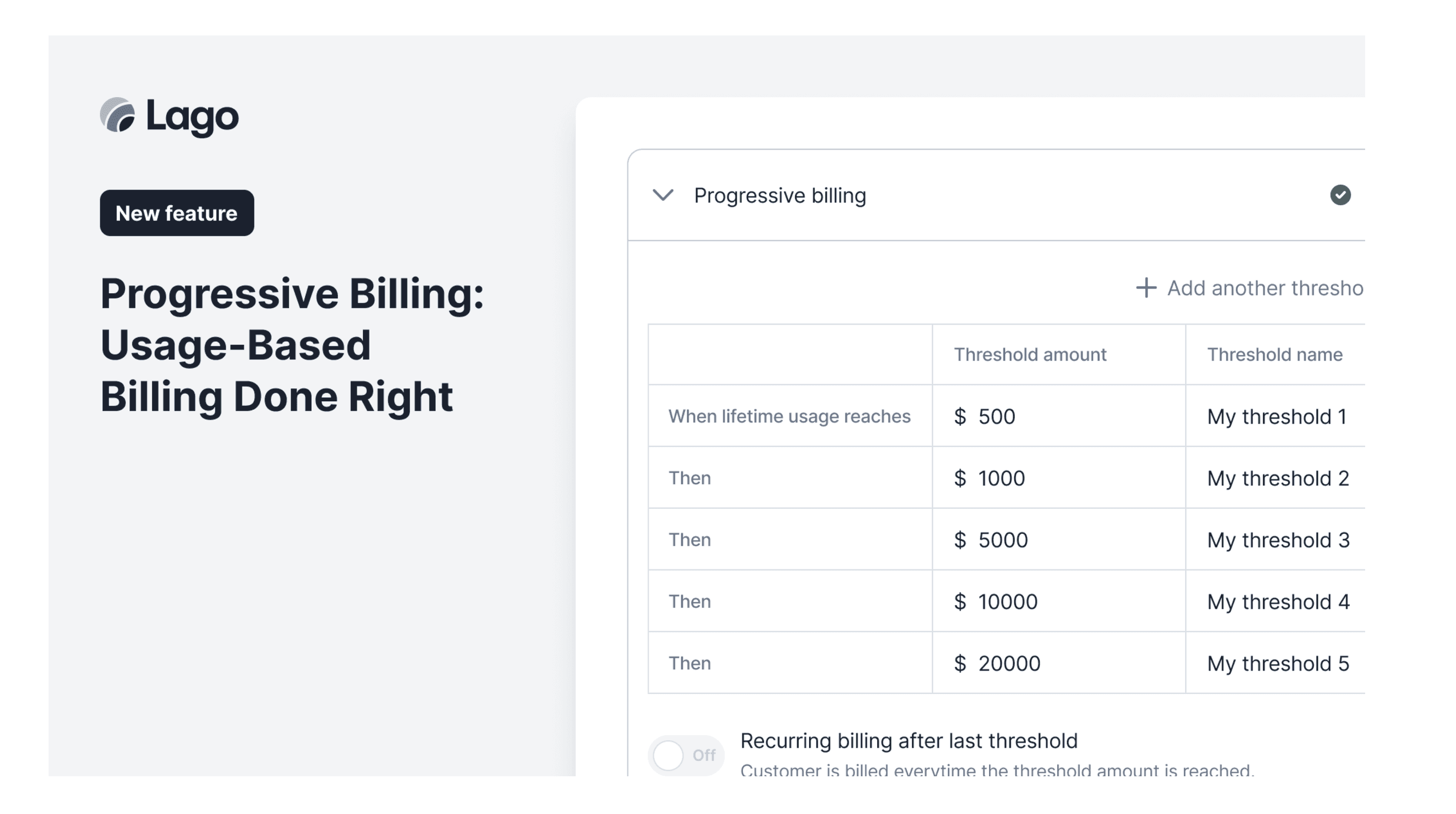

Tools like Lago offer progressive billing features. For example, customers can be billed when they cross specific usage thresholds, ensuring gradual payment collection and avoiding end-of-period billing surprises.

Lago’s progressive billing feature

Pre-paid Credits

Definition:

Pre-paid credits refer to a billing model where customers purchase a fixed number of credits upfront to use within a product or service. This model is widely used in usage-based pricing, enabling businesses to secure upfront payments while maintaining a usage-dependent pricing structure.

Example:

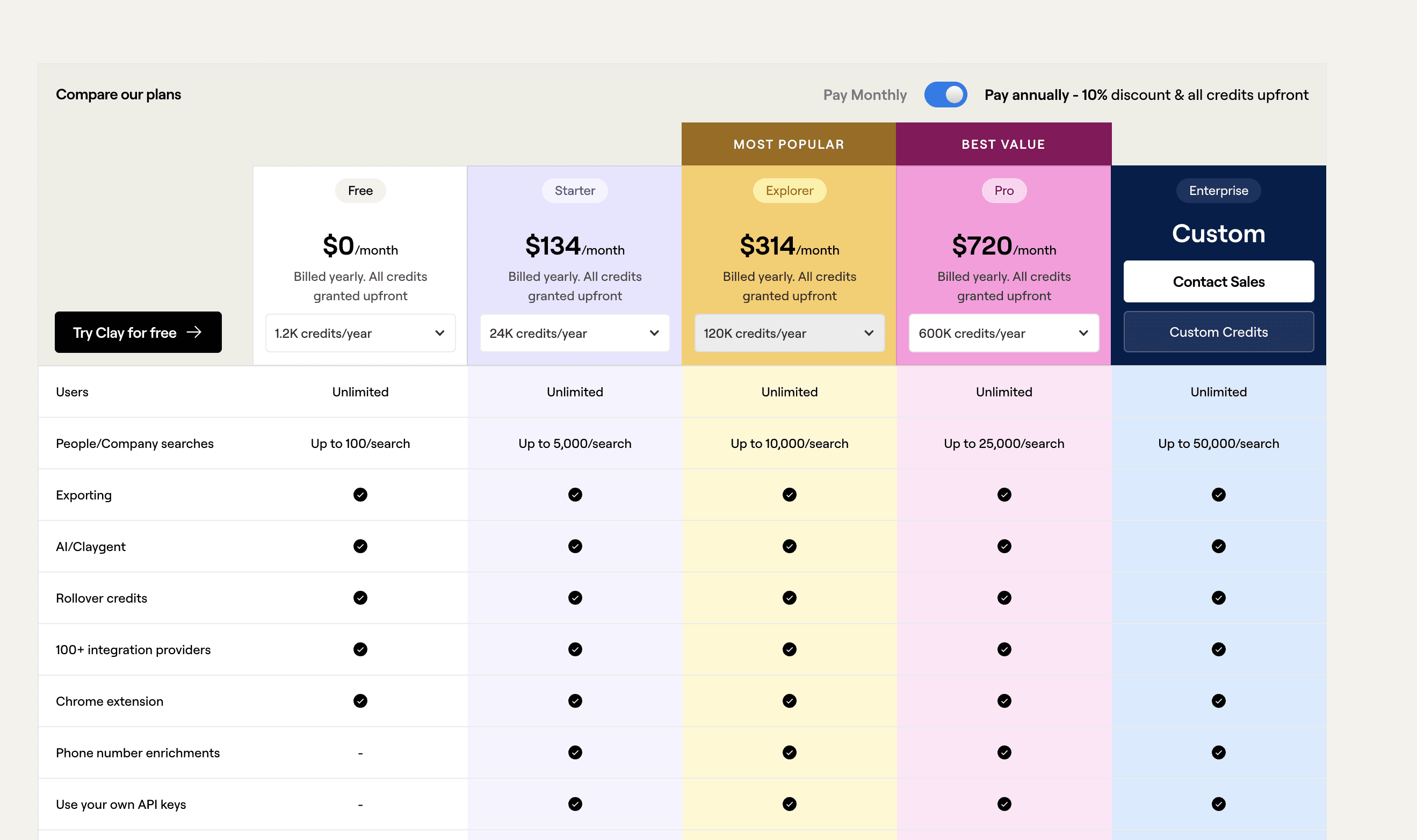

Clay uses a credit-based pricing model where customers are allocated a specific number of credits each month. These credits are consumed based on usage, ensuring flexibility for customers while guaranteeing predictable revenue for the business.

Clay’s pricing page

Billing and Product

Price Localization

Definition:

Price localization involves optimizing price points based on customer geography. It goes beyond merely adjusting prices to reflect exchange rates; it includes setting region-specific pricing within the same currency for different areas, even within the same country, to better align with local purchasing power or market conditions.

Example:

1price.co allows SaaS companies to define dynamic pricing based on the IP address of website visitors. For instance, a visitor from a high-income region might see a higher price compared to a visitor from a lower-income region, enabling businesses to localize prices effectively.

1price’s SaaS notably enables to localize pricing

Feature Flags

Definition:

A feature flag is a mechanism used to control access to a specific feature without requiring code changes or technical intervention. It allows teams to enable or disable features for specific customers or segments, providing flexibility in feature management.

Example:

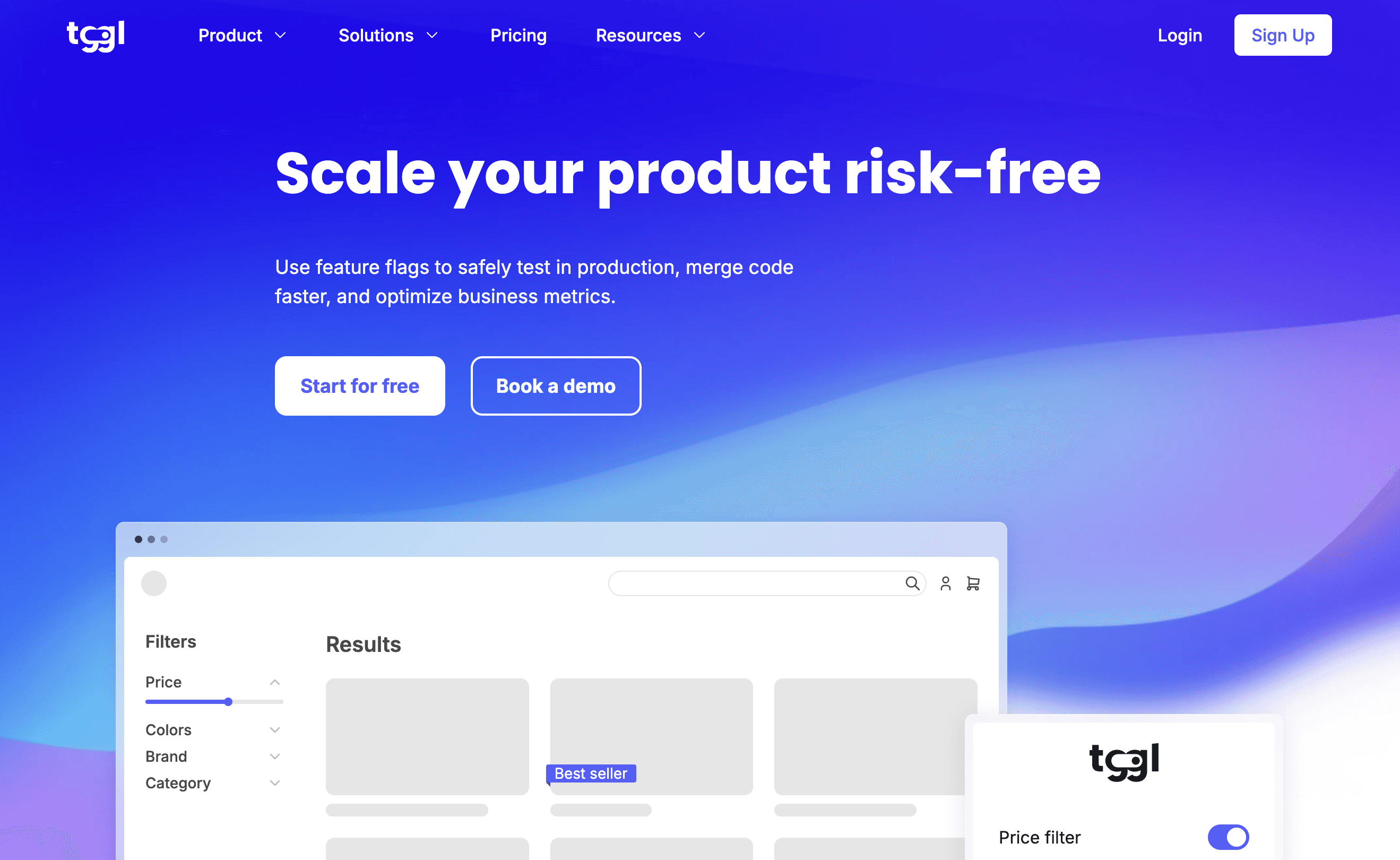

If a customer does not have access to SAML-SSO on their current plan but needs temporary access, a feature flag can enable the sales team to activate SAML-SSO for that customer without modifying the plan or involving engineering resources. Some specific products like Tggl, LaunchDarkly or Unleash enable to configure feature flags within your SaaS.

Tggl is a feature management tool

Feature Entitlement and Overrides

Definition:

Feature entitlement defines a customer's access to specific features based on their subscription plan. It can be expressed as a boolean (true/false), a usage limit (e.g., "100 users"), or a string (e.g., "tier-1 support"). Overrides occur when a feature’s default entitlement is customized for a particular customer.

Example:

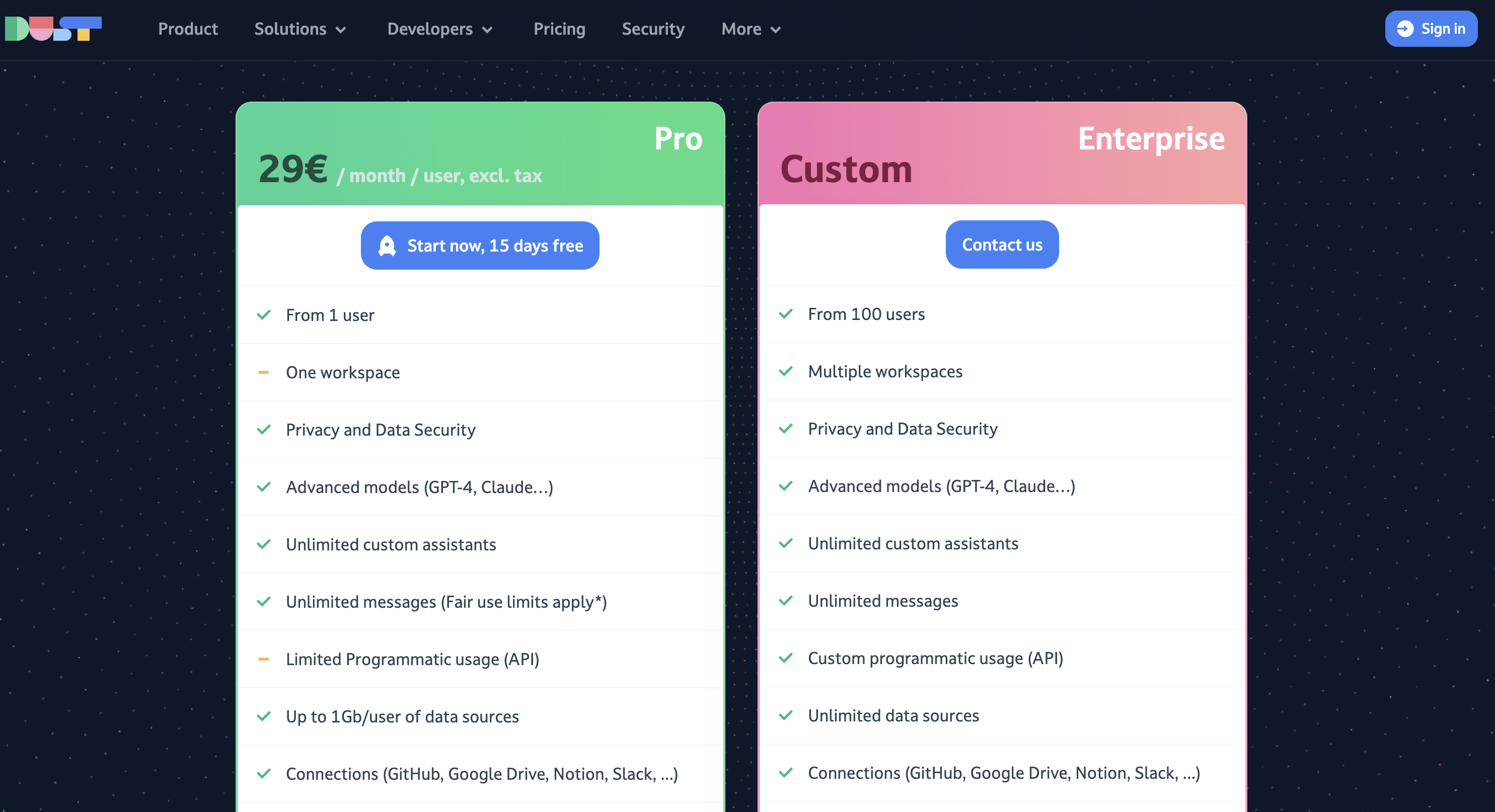

In Dust, the entitlement for "Multiple Workspaces" is "true" for Enterprise plan users but "false" for Pro plan users. Similarly, the entitlement for "Number of Users" is "100" on the Enterprise plan but limited to "1" on the Pro plan. These settings can be overridden if a specific customer requires custom access.

Dust’s pricing page

Customer Provisioning

Definition:

Customer provisioning refers to the process of configuring a customer's account, plan, and feature entitlements after they subscribe to a service. It ensures that customers have appropriate access to features and resources based on their plan. Provisioning can be manual (sales-led) or automated (self-service).

Example:

At Livestorm, Enterprise customers are provisioned manually by the sales team, who configure custom pricing, limits, and features. Conversely, Pro plan users are automatically provisioned through the website when they subscribe, requiring no manual intervention.

Proration

Definition:

Proration is the process of calculating charges or credits for a partial billing period when a customer upgrades, downgrades, or cancels their subscription. It ensures customers are billed only for the time they used a service at a specific price, adjusting for the difference between old and new plans or unused service time.

Example:

Suppose a SaaS company charges $100/month for its basic plan and $200/month for its premium plan. If a customer switches from the basic to the premium plan halfway through the billing cycle, they would be charged $50 for the basic plan and $100 for the premium plan, reflecting 15 days of each plan. Tools like Paddle or Chargify automate this proration to ensure fairness and accuracy in billing.

Customer Portal

Definition:

A customer portal is a self-service interface that enables customers to manage their account details, billing information, subscriptions, and feature entitlements. It enhances transparency and reduces the need for customer support by allowing users to perform tasks like updating payment methods or upgrading plans.

Example:

Stripe’s customizable Billing Customer Portal allows SaaS customers to manage subscriptions, view past payments, and update billing information. For example, a user can log in to switch from a monthly to an annual plan and see the updated pricing instantly.

Paywall/Checkout Page

Definition:

A paywall or checkout page is the final stage of the purchase process where customers review their chosen plan or product and provide payment details. It serves as both a pricing presentation tool and a payment collection mechanism, playing a critical role in conversion optimization.

Example:

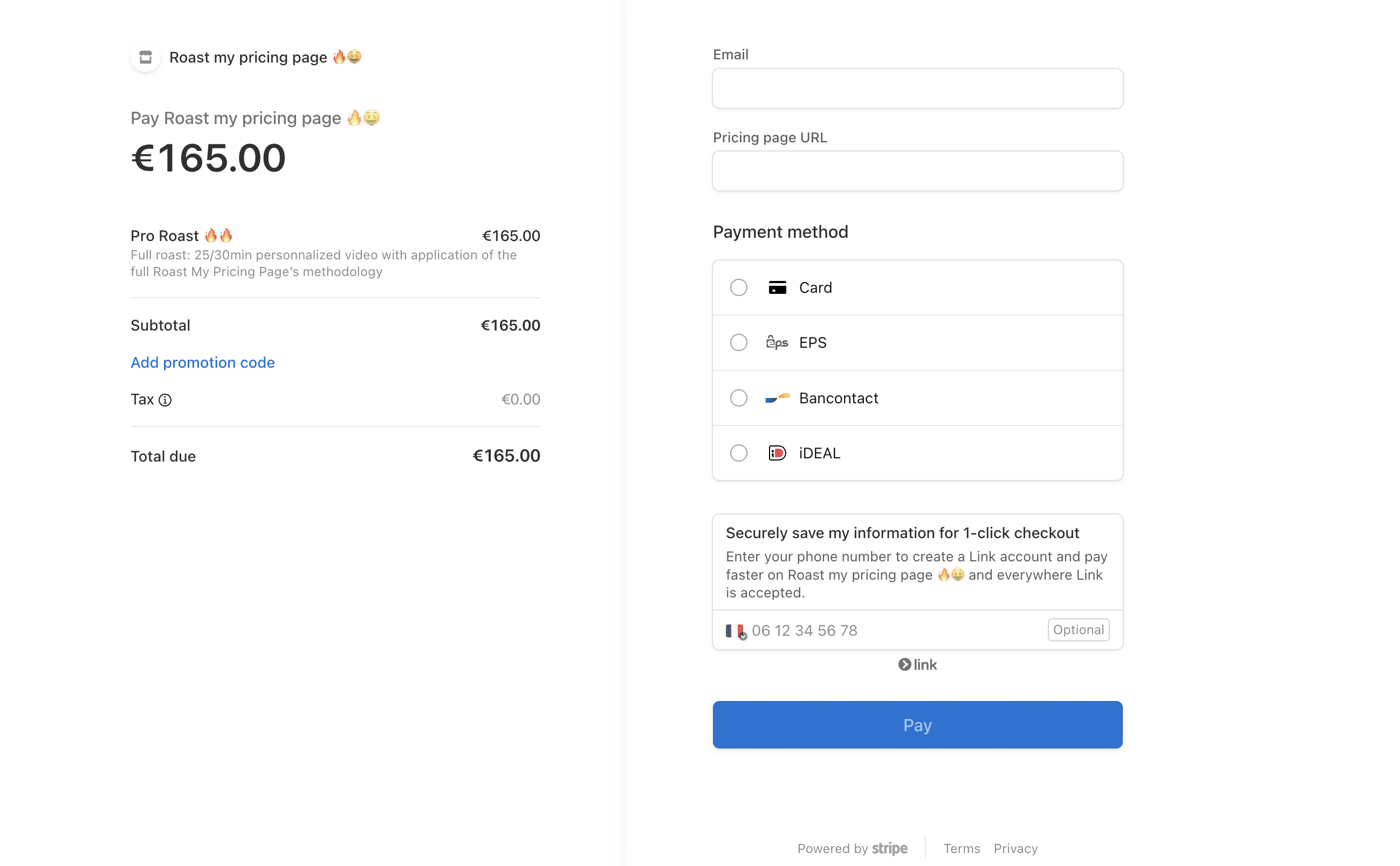

Roast My Pricing Page uses Stripe to host its checkout page. While Stripe offers limited customization, it efficiently handles pricing presentation and payment processing, ensuring a smooth checkout experience.

Here’s the checkout page you go through when you pay for a roast of your pricing via Roast My Pricing Page

Pricing Experimentation

Definition:

Pricing experimentation involves testing various pricing strategies, models, or tiers to identify the most effective method for maximizing revenue and customer acquisition. Techniques include A/B testing, introducing new pricing models, and offering limited-time discounts to understand customer behavior.

Example:

Netflix conducted pricing experiments by introducing an ad-supported plan at a lower price point to attract cost-sensitive users. They compared its performance against traditional ad-free plans to assess customer preferences and revenue impact.

Billing and Legal

Revenue Recognition

Definition:

Revenue recognition is the accounting principle that determines the specific conditions under which revenue is recognized or recorded in financial statements. In the context of SaaS, it ensures that revenue is recognized as the service is delivered, rather than when the payment is received.

Example:

A SaaS company offering an annual subscription for $1,200 cannot recognize the entire amount upfront. Instead, it must recognize $100 each month as the service is delivered, ensuring compliance with revenue recognition standards and giving a more accurate reflection of the company's ongoing obligations and performance.

Payment Reconciliation

Definition:

Payment reconciliation is the process of matching payments received with generated invoices to ensure accuracy and consistency in financial reporting. This is particularly crucial for SaaS businesses with recurring billing, as they often deal with failed payments, refunds, partial payments, or disputes. The goal is to identify and resolve discrepancies between the payment processor's records and the company's internal systems.

Example:

A SaaS company using Stripe as a payment processor reconciles its monthly payment records by comparing Stripe’s transaction data with its internal revenue reports. For instance, if an invoice for $500 is marked as unpaid in the company’s system but appears as processed in Stripe, reconciliation will help identify and correct the discrepancy to ensure accurate financial reporting.

GAAP (Generally Accepted Accounting Principles)

Definition:

GAAP refers to a standardized set of accounting principles, procedures, and standards that companies in the United States must follow when preparing financial statements. It ensures consistency, transparency, and comparability of financial reporting across businesses. For SaaS companies, GAAP provides guidance on how to handle areas like revenue recognition, deferred revenue, and expense reporting.

Example:

A SaaS company transitioning from monthly to annual billing plans must follow GAAP rules to record revenue. For instance, if the company receives $12,000 upfront for a yearly plan, GAAP requires the company to record only $1,000 per month as revenue and classify the remaining $11,000 as deferred revenue until earned.

Compliance

Definition:

Compliance in the SaaS world refers to adhering to regulations, standards, and policies that govern data security, privacy, billing practices, financial reporting, and customer verification. This includes frameworks like GDPR for data protection, PCI-DSS for payment security, and ASC 606 or IFRS 15 for revenue recognition. Additionally, compliance often involves performing Know Your Business (KYB) or Know Your Customer (KYC) checks to verify customer identity and ensure they are not listed on sanction lists or involved in activities like terrorism financing or money laundering. Maintaining compliance is crucial to avoiding fines, building customer trust, and scaling operations globally.

Example:

A SaaS platform offering global financial services must comply with GDPR for handling EU customer data and PCI-DSS for secure payment processing. Furthermore, the platform conducts KYC/KYB checks using a tool like Jumio or Onfido to verify customer identity and ensure no customers are listed on international sanction lists, safeguarding against regulatory violations and financial crimes.

Onfido’s enable to set-up KYB/KYC workflows