Understanding Usage-Based Pricing: an Overview of Key Features, Advantages, and Common Challenges

From pay-as-you-go to credit burndown, learn how different pricing models work, their pros and cons, and how they can impact SaaS revenue.

Sep 27, 2024

Usage-based pricing has become increasingly popular in the SaaS market, with companies like Livestorm and Zapier recently adopting this model. As more companies embrace it, a specialized ecosystem has emerged, with tools like Metronome, Orb, and Lago, alongside established players like Stripe and Chargebee (which recently acquired Octane). However, this rapid growth has led to confusion around terminology.

While "usage-based pricing" is straightforward—you pay based on your usage—the various underlying billing models create a lot of uncertainty: pay-as-you-go, metered billing, pay-per-use, credit burndown, stair-step, overage, and more.

In this article, I’ll clarify the most common usage-based pricing models to help you make sense of the jargon. I’ll also list what are the pros and cons of each of those pricing models in my opinion.

The “Credit Burndown” or “Credit-Based” Model

Customers pay a flat fee at the beginning of the billing period for a given number of credits defined by various packages.

A credit can be defined as an API call (ex: OpenAI), an extracted email (ex: Evaboot), a task (ex: Zapier) or any other usage metric that correlates with the value that your product delivers.

When customers reach their limit of credits, they must upgrade to a higher package to continue using the product.

Unused credits usually don't roll over to the next billing period, helping SaaS companies boost margins. However, some businesses, like Evaboot, do enforce rollovers. With Evaboot, you pay for the number of emails extracted and cleaned. Any unused credits are automatically added to the next month’s total.

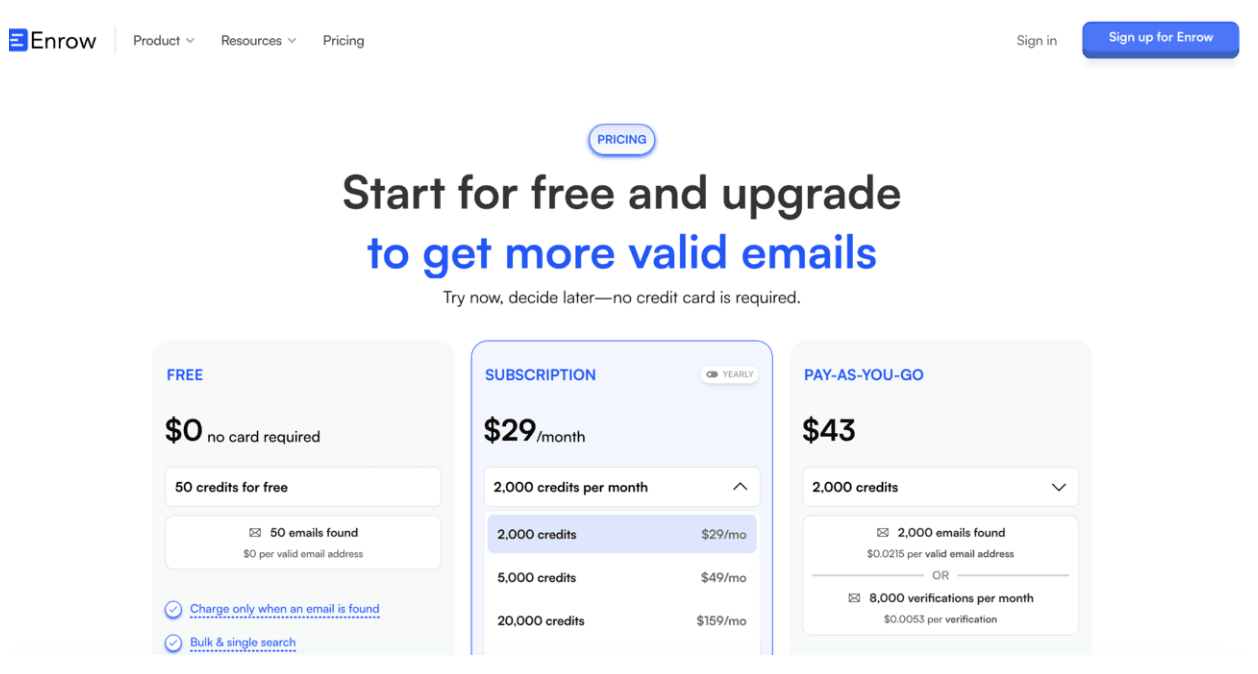

Enrow has a credit-based pricing model where you select a number of emails you plan to retrieve each month

Pros:

Customers pay upfront at the start of the billing period, improving your working capital. It also reduces outstanding payments if access is correctly blocked when payment is due.

Customers aren’t surprised by their invoices and don’t feel misled. They know exactly what they are going to pay for. Even if they have to upgrade, they’ll know how much they will pay on the higher plan.

This model aligns with standard SaaS metrics. Since pricing is tiered and fixed, metrics like ARR and LTV remain applicable, making revenue forecasting and valuation straightforward.

Cons:

Without a pay-per-unit option, customers are forced to upgrade when they reach their limit. They may end up overpaying for a higher plan, even if their usage is only occasional. This can cause frustration, especially in months with irregular usage.

If your billing software doesn’t support this model (like Stripe which does not offer it natively to date), it adds extra work. You'll need to regularly track the consumption of each plan manually.

If you don’t have a low-usage tier or a free trial, customers are forced to pay for something without first experiencing its value.

Customers can find it sometimes a bit tricky predict what is the accurate tier they need to opt for as they may not know in advance their usage. To solve that, make sure you provide a pricing calculator that will help customers predict their usage.

The “Pay as you go” or “Pay per use” Model

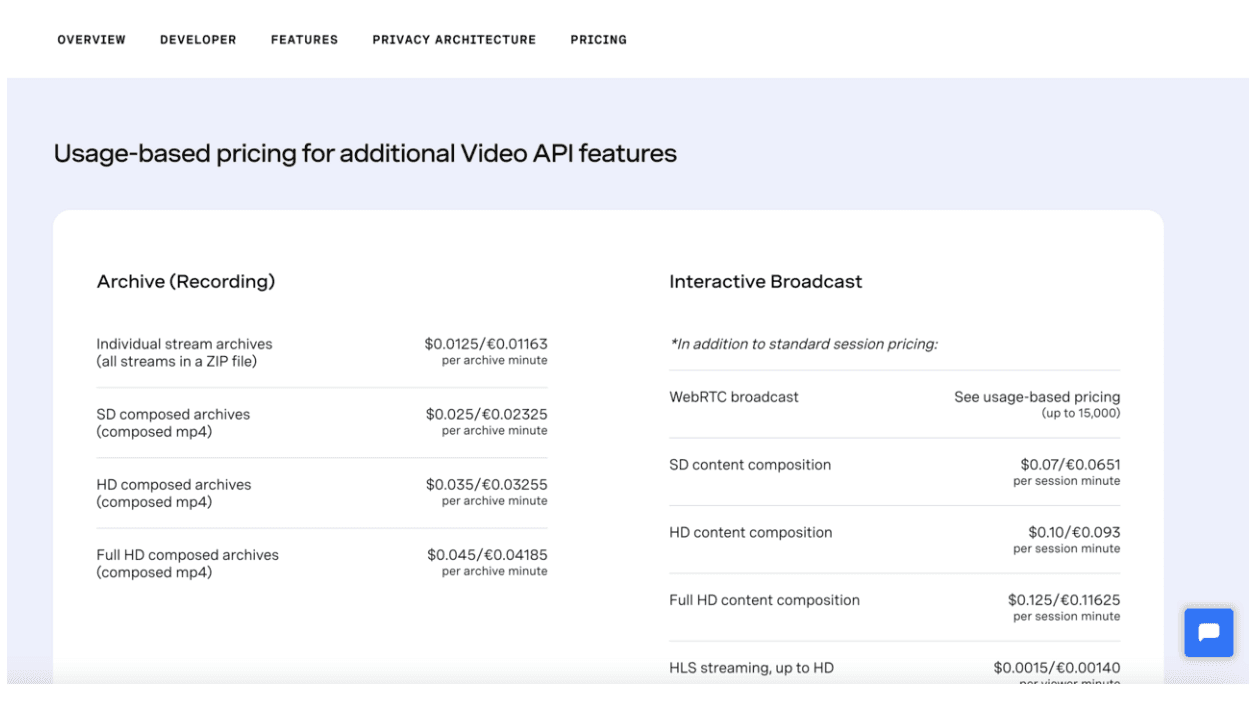

Ex: Gladia, Twilio, Vonage’s Video API

Customers pay at the end of their billing period (usually monthly or yearly) based on their usage. Billing software like Stripe or Chargebee refers to this model as “metered billing.” However, I believe this is more of a billing term, not one you should use when communicating with customers. The software “meters” (measures) usage, sends this usage to the billing software so that the customer can be billed accordingly.

There are various subsets of this model:

Per Unit or Per Quantity: you charge the same amount for each unit (e.g, $1 for each unit)

Per Package: you charge the same amount for each package of unit (e.g, $1 for each 30 units consumed)

Per Volume: the amount charged per unit decreases as volume increases (e.g., $15 per unit between 1 and 10, then $10 per unit between 10 and 100).

Tiered-Based or Graduated Pricing: you charge based on usage in each tier. For example, if you charge $15 per unit between 1 and 10 and $10 per unit between 10 and 100, consuming 12 units at the end of the month will cost $170 (10*$15 + 2*$10).

Vonage’s video API feature bills based on the number of video session minutes

Pros:

For your company, it helps control margins. If you have high usage costs, like API or video streaming fees, it ensures revenue is directly proportional to usage, more so than a credit burndown model.

Since it’s very flexible, it enables customers to start with a low price to start capturing value, and ultimately pay more when they have witnessed the value

It’s easy for customers to understand. The term “pay as you go” is self-explanatory.

It also clarifies your value proposition. If customers pay for each API call, it signals that your company delivers value with every use.

Cons:

It might discourage some customers from using your product, as they know they’ll be charged each time they use it.

Without alerts or usage caps, customers may overspend. A team member could unknowingly exceed limits, leading to overages. This can cause disputes (customers may refuse to pay) or operational headaches (your support team may have to offer concessions or write off part of the overage).

Customers often pay at the end of the billing cycle, usually monthly, even with yearly plans. This can hurt your cash flow if you need funds to cover high usage costs.

As a company, your revenue isn’t truly ARR, which can be an issue, especially for VC-backed businesses, as it complicates valuation. You only generate recurring revenue if customers use your product consistently. If their usage is seasonal, your revenue will drop during low-usage periods.A Hybrid Model that combines both “Credit Burndown” and “Pay as you go”

A Hybrid Model that combines both “Credit Burndown” and “Pay as you go”

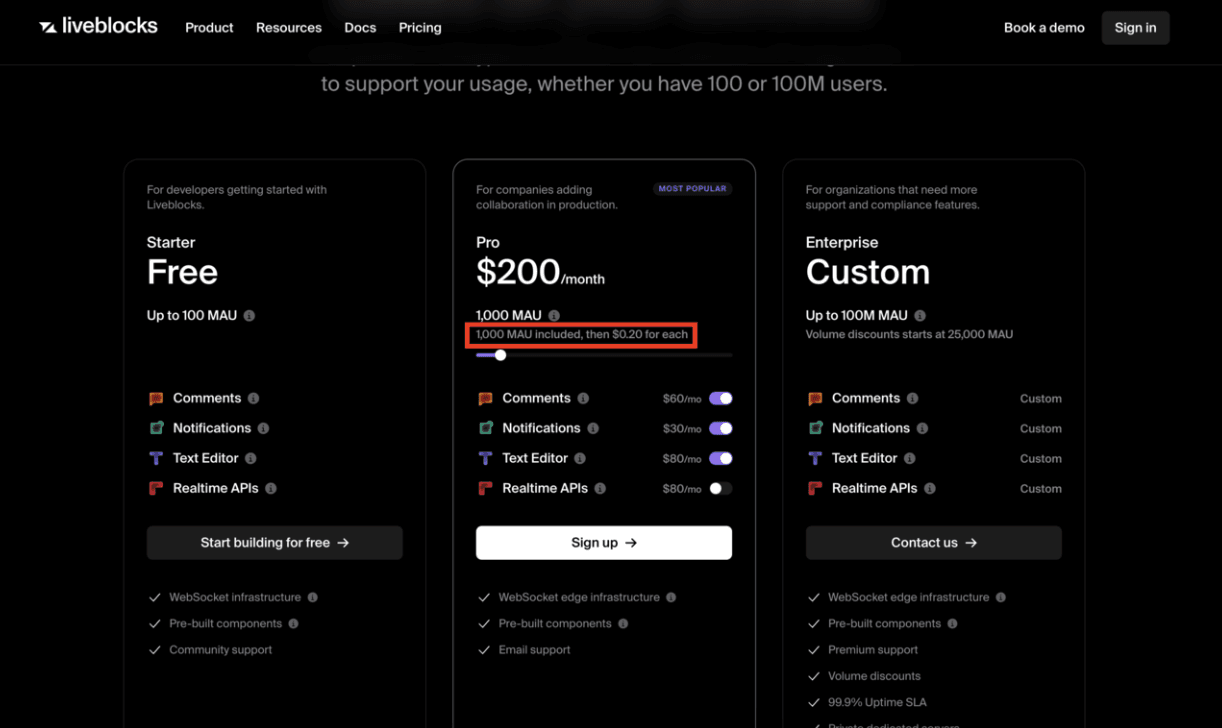

Ex: Liveblocks, TextRequest, Gorgias

Customers pay for a set number of credits at the beginning of the billing period ("Credit Burndown"). When they reach their limit, they can either upgrade to a higher package or pay extra (Pay as you go) at a higher unit price.

The fact that you can pay additional pay as you go credits solves one of the main “Credit Burndown” business model’s cons: if you have an abnormal usage for a specific month, you don’t necessarily have to upgrade to a higher plan, you can still just pay for additional credits (even if the unit price may be higher).

Liveblocks pricing models is based on MAU-based tiers with the possibility to buy additional credits

Pros:

It combines the best of both worlds: "Pay as you go" and "Credit burndown." You get the benefits of the credit system with the flexibility of pay-as-you-go.

Cons:

It adds complexity to the implementation:

You’ll need a deeper integration with your billing software. Both models—credit burndown and pay-as-you-go—will generally require separate plans in the system.

You must ensure a seamless user experience. Offering pay-as-you-go credits means adapting user flows, making sure they appear at the right time and in the right place.

The “Outcome-Based Pricing” or “Result-Based pricing” model

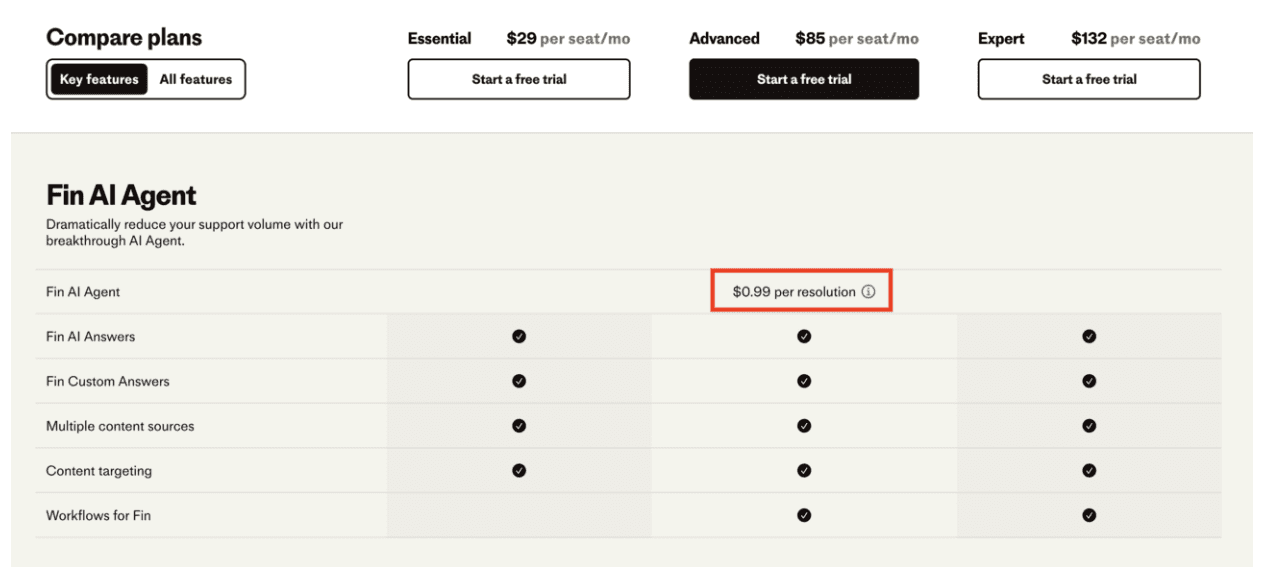

Ex: Stripe, PayPal, Intercom Fin AI Agent feature

For example, Stripe and PayPal charge a percentage of each transaction processed. This fee is tied to the results you gain—successful transactions—rather than your usage of the service itself.

Intercom's Fin AI feature, an AI agent that automates support tasks by generating responses, is priced based on the number of tickets it resolves. The cost isn't tied to the number of answers the AI provides, but solely to the number of solved tickets.

Unlike a "Pay-as-you-go" model, where costs are based on direct usage, outcome-based pricing charges you based on the value or results you receive. With Stripe, you don’t pay for each API call or setup. Instead, you pay when a transaction occurs, linking the fee to the outcome: a completed payment.

Intercom Fin AI Agent’s feature is monetized based on the price per resolution

Pros:

This type of business model can significantly boost your conversion rate. Customers pay only when they see results from your product. This allows them to start for free, implement at their own pace, and begin paying once they capture value.

Revenue is directly tied to the value your product delivers. This pushes your product team to constantly improve, ensuring a high-quality product. Customers benefit, knowing you’re motivated to maintain that standard. In the end, both parties' interests are aligned.

Cons:

It may require custom implementation, as most billing systems don’t natively support this model.

Like the “Pay-as-you-go” model, it lacks guaranteed recurring revenue if usage drops.

To recap: 4 main usage-based pricing models

“Credit-Based” Model: you subscribe to a plan tier that grants you a number of credits like for OpenAI

“Pay-as-you-go” Model: you pay proportionally to the usage of the platform like the number of SMS you send in the case of Twilio

A hybrid model between “Credit-based” and “Pay-as-you-go”: you can pay additional credits when you reach the limit of your "Credit-based” plan

A “Result-based model”: you pay based on the results you get from the usage of your platform like Stripe that charges fees based on the number of transactions